I have been hearing my parents emphasize the importance of savings from the day I was born. Reducing your expenses and saving for the future was the mantra they followed. There’s nothing wrong with it. Our parents were born at a time when India was only beginning to stand on its feet. So naturally, our parents saw savings as a safety net for the future.

Cut to 2021 and times have changed. India is now opening its wings to fly. And with it comes a drastic change in lifestyle in the current generation. As much as we like to plan our savings for the future, what we really want is to plan our expenses to achieve our goals.

At Jupiter, our north star is to make a financial wellness app. And since savings is a powerful way to achieve your financial goals, we’re introducing Pots. In this blog I have put down some design nuances and everything-you-need-to-know about Pots.

Let’s consider the problems associated with savings today

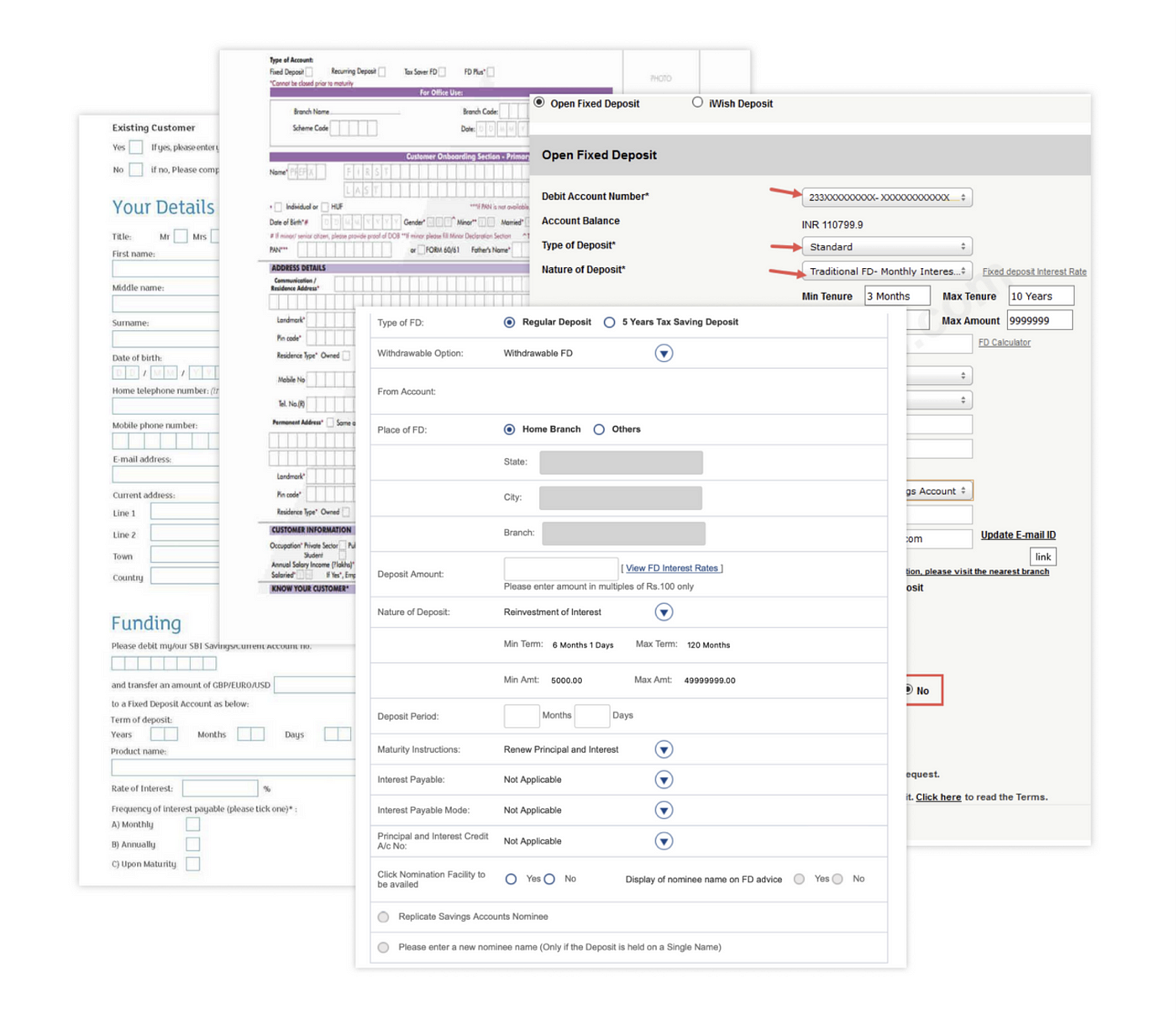

TLDR — filling forms the length of encyclopedias with waaaay too many fields. Ironically, most of the information asked is already available with your bank but the bank still requires you to fill form after form. Why? Cause protocol. Painful. 😢

An alien language. The bank forms are filled with a galaxy of confusing jargon, which, let’s be honest, a regular human has no clue about — “Interest payment mode, maturity instructions, principle to be credited to which account, which apple pie you ate yesterday?” 😡

Most importantly, most people have no clue about “how much to save and for what.” 🧐 We save endlessly hoping to find a use for the savings some day.

Lock-Ins. Bank FDs and RDs come with a minimum investment timeframe. As a generation raised on swiping endlessly on platforms such as Tinder and Instagram, we are petrified of any sort of commitment. What we seek is freedom.

Social & family pressure. Every family gathering we feast on a lavish meal with a serving of savings gyaan on the side from that one uncle who (legend has it) has mastered his finances.

Introducing Pots

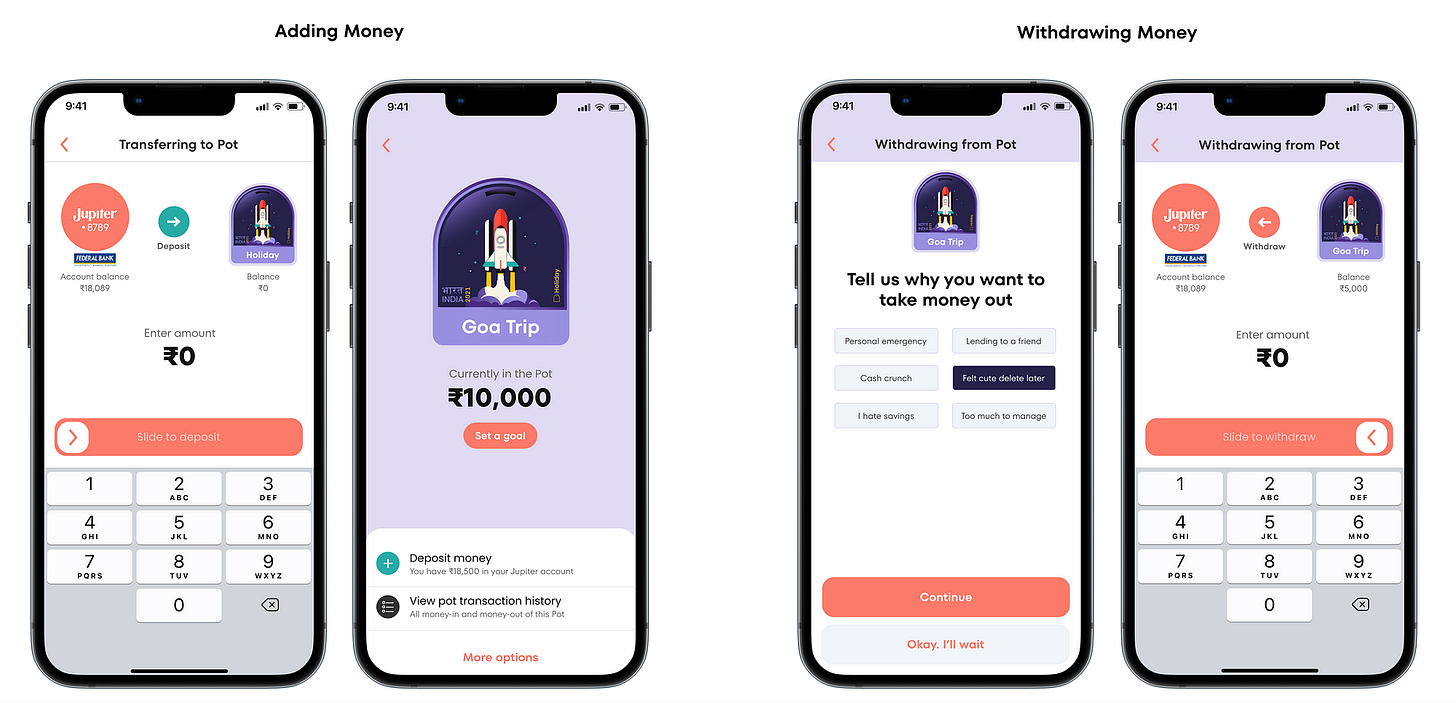

A Pot is a space (think of it as a sub-account) in your Jupiter account in which you can park your money away from your main balance. What’s the point you ask?

It’s designed to help you save — you can make a Pot for any goal such as your travel fund, your phone upgrade kitty etc. You can deposit & withdraw anytime. You earn 2.5% interest rate annually.

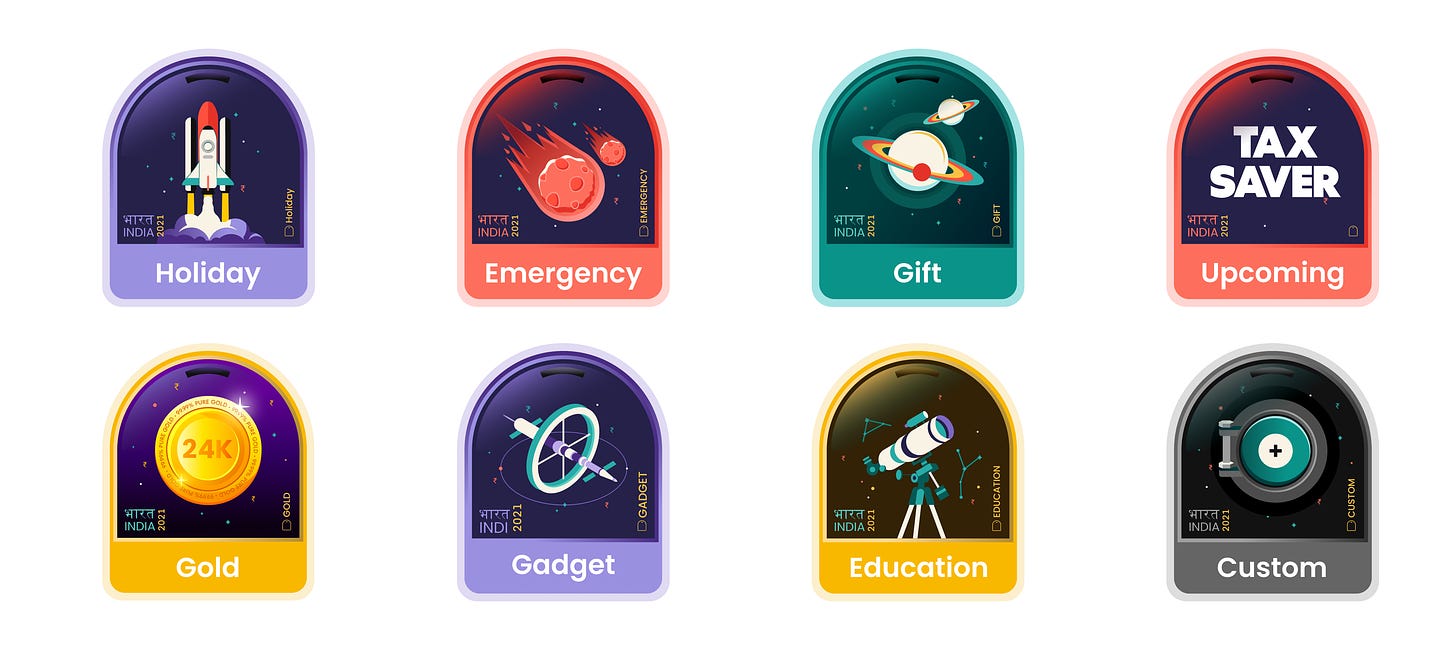

These Pot categories are selected after conducting extensive user research (1K). In our research we found that around 80%+ users wish to save but don’t really have a purpose for saving. And this confusion of “save for what?” ultimately leads to the million-dollar question of “how much to save?”.

Through conversations with our community we realized that when customers are served with the right context and ideas, the possibilities are limitless. As your new-age banking partner, we are as concerned about your small, everyday dreams as we are about your big, once-in-a-lifetime ones. So, with Pots, gifting your parents a trip to Coorg on their anniversary can earn you valuable brownie points. Paying off your 2 wheeler loan by putting money aside in a Pot can help you make informed decisions for the future. Saving money for a rainy day in the “Emergency” Pot can help you throw a party at the drop of a hat. And for your colorful imagination, we even have custom Pots — for the goals that are uniquely yours. You can literally create a Pot and save for every expense.

How does it work?

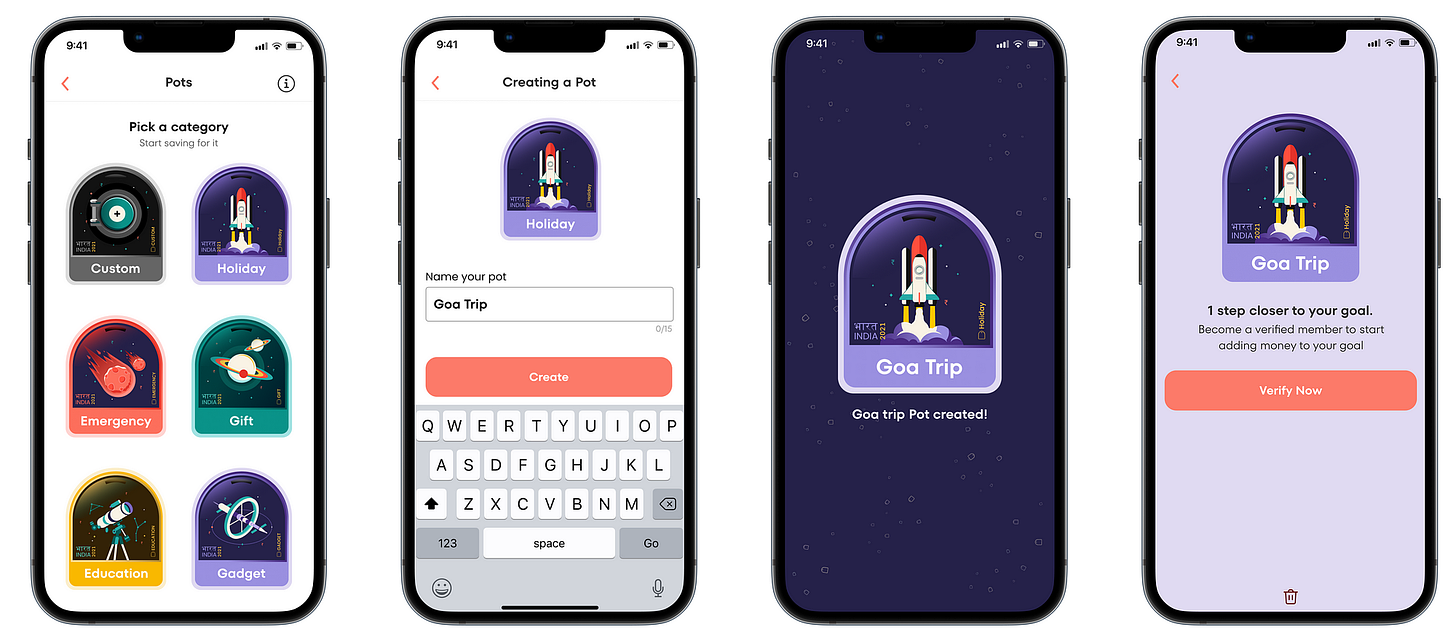

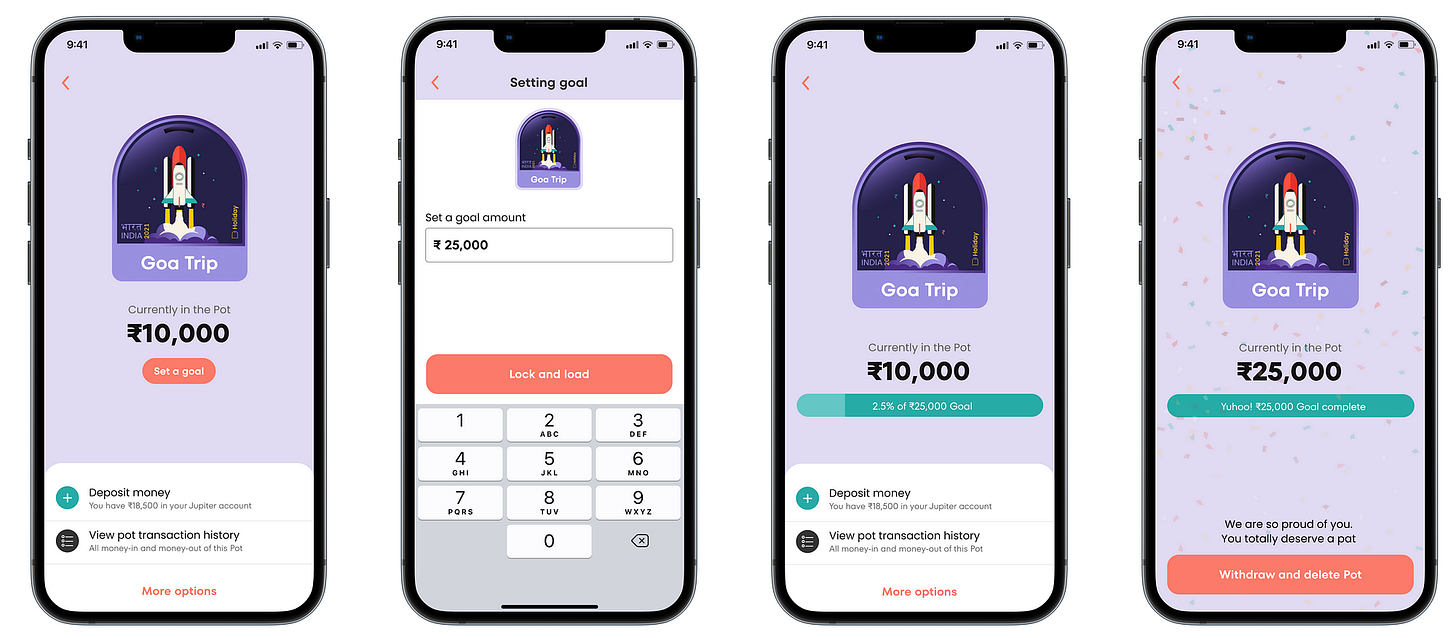

Step 1: Create a Pot anytime by simply picking a category and assigning it a name. And voila! Your Pot is created

Step 2: To deposit money in your Pot, first you will have to complete a full video verification (FKYC). This will internally create a sub-account and will give you tools to play with your Pot.

Step 3: Once your verification is done, you can add and withdraw money from your Pot anytime.

Step 4: Create a goal. This is the most important step that will empower you to achieve your goals. Once a goal amount is set, we will keep nudging you to save at regular intervals. Keep depositing religiously and boy, soon your dreams will be fulfilled.

Apart from creating a Pot, we constantly display the balance in your Pot and remind you to add money or set a goal. All of this comes together in your “Money tab”

A bit about the design language of Pots

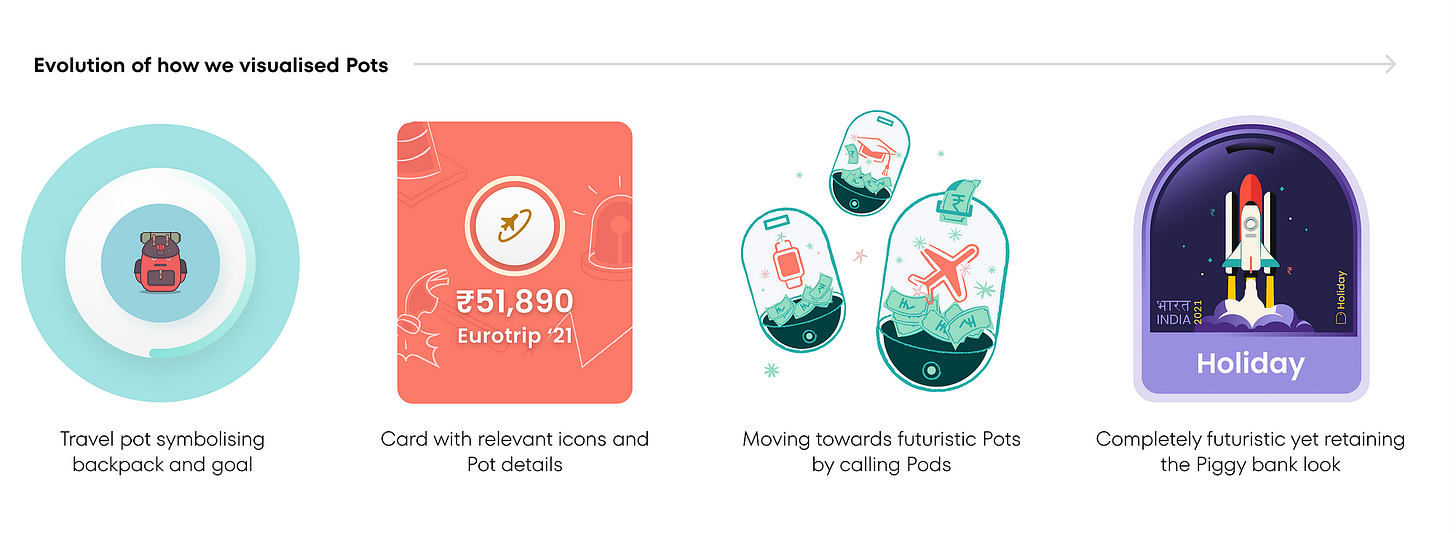

We have been working on Pots since the very inception of Jupiter. Like any design process, we brainstormed on various visual references. A quick view of how the visualization of Pots evolved -

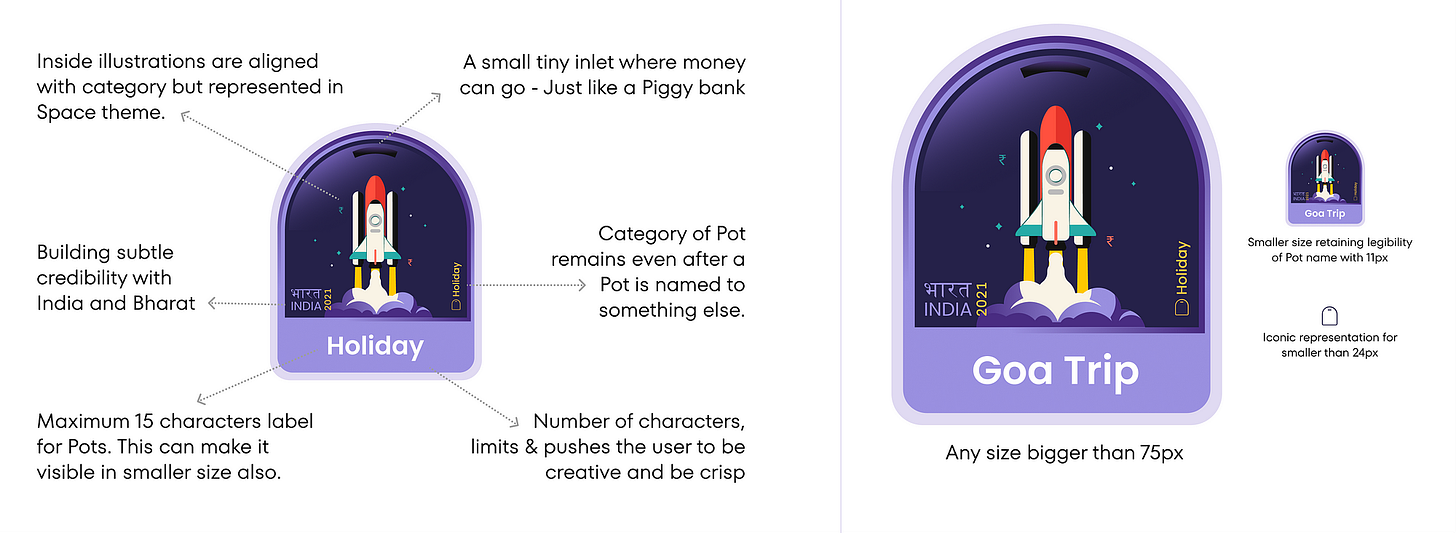

The final Pot representation has some nerdy stuff behind it’s construction. The tiny details help us in motion design and in repurposing the same assets at various places across the app and outside it.

Well as they say in the startup world, this is just an MVP — the tip of the iceberg. We are working on some really cool stuff — creating more Pot categories such as Crypto, Gold, Tax Saving, Mutual Funds and more. All this with auto-recurring deposits. Stay tuned for the saving challenge game this season! We promise to help you save better.

Pinky Promise! (That coming soon too 🙊)

Our Pots pod is the coolest pod in Jupiter. We are constantly tinkering with ideas to help people save and are speaking with users everyday to solve their problems. Pots is led by Rahool and his team — Ayushi, Pankit, Preetpal, Vasudha, Govind, Pranay, Bharat Gupta, Saakshi, Deepak Varadharaj, Bala and many other teams that help bring it to life. Special thanks to Tejasvi Gulati for helping with this blog post.

We are super excited to bring you Pots. Download the Jupiter app, complete your full verification and start your journey of financial freedom by saving in Pots.